The Latest Quarterly Data Might Surprise You!

In my articles on the Royston property market, I like to provide an insight into the real story of what is happening in our local (and national) property market and address the misconceptions that some of the media have been spreading.

Despite almost daily reports of a housing market crash since September 2022, the data shows that the UK (and Royston) property market is gingerly doing OK.

So, let’s dive into the stats and start with the life blood of the housing market – new properties coming on to the market.

Nationally, 407,946 UK properties came onto the market in Q1 2023.

(Q1 = Jan & Feb & March)

Interesting when compared to the 7-year average (2017 to 2023 inclusive) of 403,105 new properties on the market in Q1.

New properties coming onto the market are a critical bellwether of the property market.

If we had a situation like 2008, where the number of properties coming on the market in 2008/9 was double that of 2007, supply outstripped demand and hence economics dictated and house prices fell.

The balance of houses coming on the market and how many sell determine what happens to property prices.

So how do you know if we are heading for another Royston house price crash as we did in 2008 or not, as the case maybe?

Let me share a quick and easy way to find out before anyone else.

Firstly, do a Rightmove search on your chosen property market and map the number of properties for sale every week. Next, do the same search, but this time include sold subject to contract properties. This will show you can see how many properties are available and how many sold subject to contract (stc). The third step is to calculate the ratio between the first two numbers: i.e., what’s available versus what’s been sold.

If the ratio of sold property to available property rises monthly, the market is improving. If the ratio is falling, the market is slowing.

If you really wish to go deep into this; you could split the search into property type (and bedrooms) you are selling and buying e.g., detached, semi, terrace or flats. This will help you to judge demand and supply and time the market to your advantage.

Next, looking at house sales nationally, 276,482 properties sold (stc) in Q1 2023.

However, the devil is in the data. The 276,482 properties sold stc is not very good when compared to the 7-year Q1 average (2017 to 2023 inclusive) of 306,532.

Yet that average includes Q1 2021, where 397,402 properties had sold stc and Q1 2022 when 341,888 properties sold. Both of those years were exceptional; however, when we compare Q1 2023 to the Q1 average of 2017/18/19/20, a more reasonable 282,488 houses were sold on average.

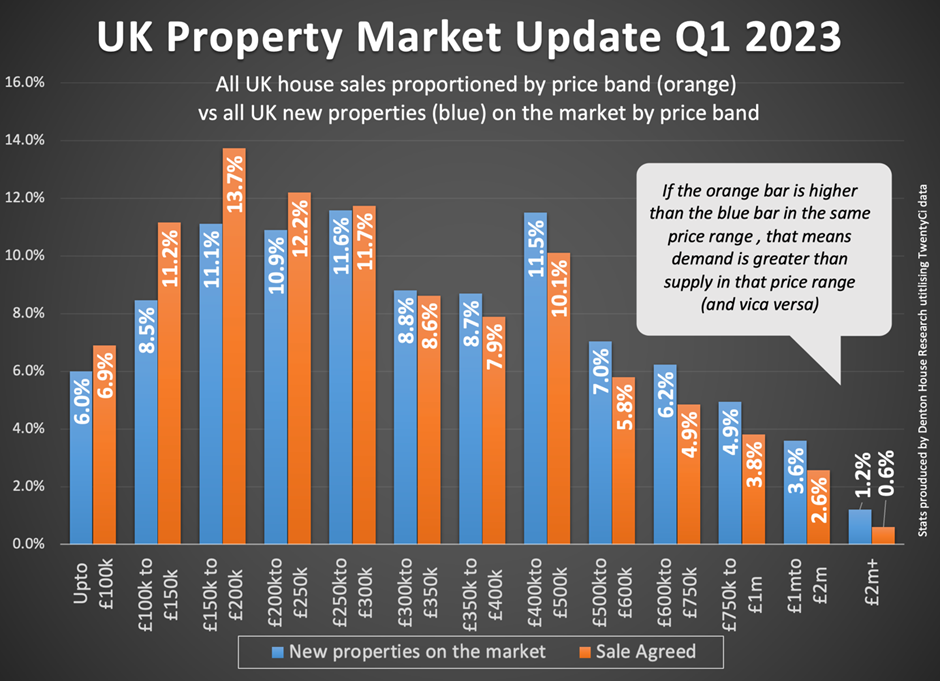

Next, I wish to look at what is selling nationally by price band.

Nearly half (44%) of all the properties sold in the UK in Q1 ’23 were £250,000 or less, yet only just over a third of the homes (36%) that came on the market in the UK in Q1 ’23 were £250,000 or less.

The lower end of the property market is performing better than the higher end.

Looking locally at the Q1 stats, starting with the number of properties in the Royston area (SG8) that came onto the market in Q1 2023…

310 properties came onto the market in Q1 2023 in the Royston area.

The average price of those Royston properties coming to the market was £547,553.

The price range/band that saw the most listings was the £400k to £500k range, where 51 Royston area properties came to market.

Now, looking at sales in Royston…

185 properties were sold in Q1 2023 in the Royston area.

The average price of those Royston properties selling was £479,869.

The price range/band that saw the most sales was the £400k to £500k range, where 33 Royston area properties were sold.

Typical first-time buyer properties are leading the recovery.

Although economic turbulence remains, the property market is gradually moving towards pre-pandemic activity levels.

The national sales agreed in this lower price band are unexpectedly recovering the fastest. However, larger, more expensive home sales are lagging (e.g., 8.5% of listings in the UK in Q1 ’23 were in the £750k to £2m price band, yet only 6.4% of the sales were in the same band). The £2m+ price range, even though the numbers are quite small, the difference is quite startling (1.2% of listings were £2m+, but only 0.6% of sales agreed were in the same range).

The average mortgage rates fell back from their peak last year, with the best rate for a 10% deposit five-year fixed mortgage now 4.6%, compared to last October at 6.62%.

However, this isn’t as good as the 10% deposit 5-year mortgage at 1.64% in January 2022.

So, what does this all mean for homeowners wanting to sell in this market?

Realistic pricing when you put your house on the market is everything!

In Q1 2023, there have been 243,602 price reductions on the 590,481 properties on the market, compared to 119,068 price reductions in Q1 2022 on 424,796 properties on the market.

It is better to come on the market at a realistic price to start when the property is fresh to the market, than go on at a high price, lose that initial honeymoon period and then reduce it, only for some people to wonder what was wrong with the property.

The Royston property market is seeing stability and confidence return as it recovers from the turbulence at the end of 2022. The pace of the market had reached an unsustainable level in the last two years, and it was on track to slow to a more normal level.

The reaction to September’s mini-Budget accelerated the speed of this slowdown.

Although higher mortgage rates and economic headwinds present challenges, many potential home buyers who were effectively sidelined in the fierce bidding wars of the last two years will find that a slower paced property market gives them time to plan a strategy for their next move as we go into the traditionally busy post-Easter house buying season.

While the demand for quality Royston houses is still healthy, if the asking price is above the current market, sellers may need help finding buyers.

Determining a realistic price is crucial but not easy. Many sellers look at similar properties on property portals, but those prices may be over-inflated.

Estate agents have more tools at their disposal, such as comparing sale prices for comparable properties and thinking about prospective purchasers in the market for the type of property under valuation.

Although getting the price right can be difficult, revising it downwards quickly is essential.

Sellers should ensure that their property looks better value for money than similar properties. If you plan to trade up, it is good sense to sell at realistic prices, as you will gain substantial savings compared to moving in the last few years.

However, if you don’t need to sell urgently, becoming a landlord could be an option – again I can help on that if needs be. Nevertheless, homeowners-turned-landlords should consider that if property values do drift downwards in the coming 12/18 months, it may take a few more years after that to recover to those values seen last year.

Whatever the rest of 2023 brings, moving home should mostly be based on your circumstances and not solely on what is happening to Royston property prices.

If you would like an informal chat about your potential move without any obligation or cost, get me around for a chat. I promise I will tell you like it is, without any guff – then you can decide what is best for you and your family.

In the meantime, do let me know your thoughts in the comments.